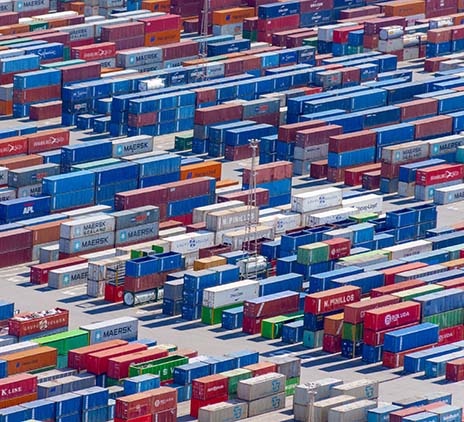

VAT and GST are growing in complexity and application, as the traditional goods and services model is replaced with digital content; virtual consumption and seamless international trade flows.

Read the latest insights from our member firms on the indirect tax changes and market trends impacting global businesses.

Read more

Tax

International indirect tax guide

Indirect tax

Indirect tax updates

Looking for indirect tax updates? Our experts share the latest updates each month.

Tax

Global developments in indirect taxation

The world of indirect tax regime is fast changing with countries adopting new and more sophisticated measures and increasing use of technology to track business transactions.

Indirect tax

Indirect tax - The Netherlands

An overview of the indirect tax rules in The Netherlands

Indirect tax

Indirect tax - Trinidad and Tobago

An overview of the indirect tax rules in Trinidad and Tobago

Our contact details

Grant Thornton International Ltd

8 Finsbury Circus

London. EC2M 7EA

T +44 (0)20 7391 9500

E gtimarketing@gti.gt.com

W www.grantthornton.global