Renewed hiring failing to boost salaries

24 Jan 2014New figures from Grant Thornton’s International Business Report (IBR)

New figures from Grant Thornton’s International Business Report (IBR) reveal that companies globally are expecting to take on more workers compared with this time last year. However, the data also shows that with significant slack in many labour markets, this increased hiring is unlikely to lead to significant salary increases across the next 12 months.

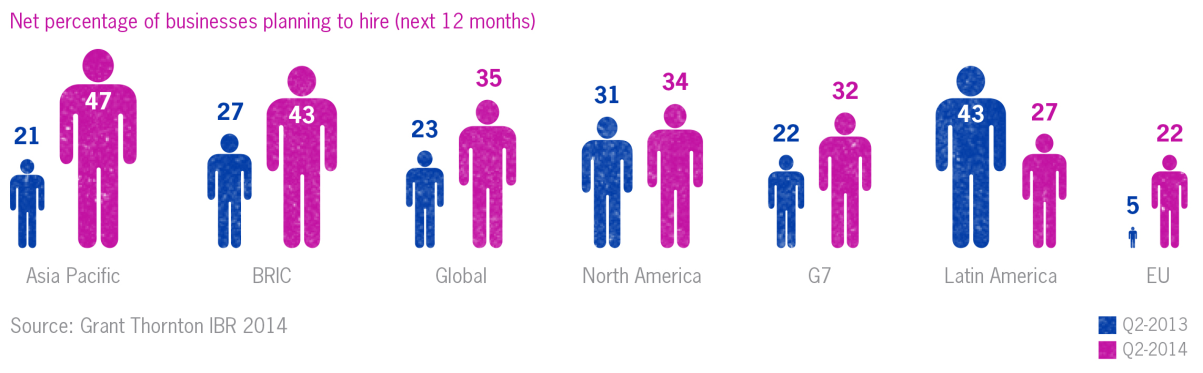

Globally, the proportion of businesses expecting to expand their workforce over the next 12 months has risen to 35%, up from 22% this time last year, and the highest since 2007. Strong hiring plans are evident across the world: 43% of BRIC businesses plan to take on new people, up from 22% in Q2-2013; in the G7 the figure is up from 22% to 32% over the same period. Net 22% of businesses in Europe expect to hire more people, up from just 5% 12 months ago; in North America the figure has risen three percentage points to 34%; and in Asia Pacific, almost half of businesses are planning to hire (47%), up from a fifth this time last year (21%). Only in Latin America have employment prospects worsened over the past 12 months.

However the impact of this extra hiring is unlikely to result in large salary increases, at least in the short-term, according to the IBR. Across the G7, just 64% of businesses plan to offer their people pay rises over the next 12 months, down from 68% this time last year, while just 10% are planning inflation-busting rises. In Europe, workers in 68% of businesses can expect to see their salaries rise, up from 55% this time last year, although this falls to just 17% who plan to offer above inflation salary rises.

Francesca Lagerberg added:

“There is still significant slack in advanced economy labour markets. Unemployment has fallen fairly rapidly in the UK and US, while Germany's employment rate remains remarkably high, but more than 10% of working age people are looking for work in Europe, rising to around one in four in southern Europe. Businesses in Europe do seem to be slowly raising salaries but with deflation now the major concern across the eurozone, the data suggest people should not be expecting large increases.

"With supply outstripping demand, businesses can afford wait for sustainable sales growth before they start investing in new workers and paying higher salaries to maintain their existing talent. The judgement of business owners and managers will be key to ensuring that productivity and profits don’t suffer as a result of gearing up too early."

Notes to editors

The Grant Thornton International Business Report (IBR) provides insight into the views and expectations of more than 10,000 businesses per year across more than 30 economies. This unique survey draws upon 22 years of trend data for most European participants and 11 years for many non-European economies. For more information, please visit: www.internationalbusinessreport.com

Data collection

Data collection is managed by Grant Thornton's core research partner – Experian. Questionnaires are translated into local languages with each participating country having the option to ask a small number of country specific questions in addition to the core questionnaire. Fieldwork is undertaken on a quarterly basis. The research is carried out primarily by telephone.