Major European powers disagree on road map

08 May 2013Major European powers disagree on road map

The future of Europe

On the eve of Europe Day (9 May), new research from the Grant Thornton International Business Report (IBR) reveals that businesses in France and Germany, the eurozone’s two biggest economies, are a world apart in their views on the bloc’s future. This highlights a concern that a lack of clarity of vision on the eurozone’s direction could lead to crippling business uncertainty and ultimately damage growth prospects.

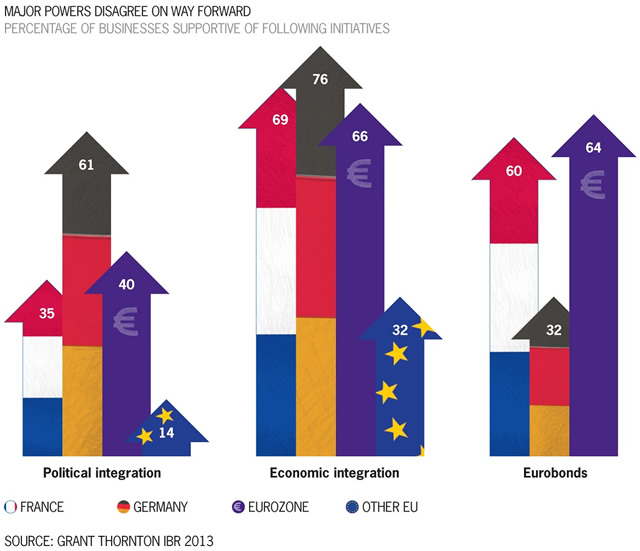

The IBR indicates that businesses in Germany are far more open to further integration compared with their French counterparts, echoing German Chancellor Angela Merkel's calls for deeper union. 61% of German businesses support further political integration and 76% further economic integration, compared with 35% and 69% in France respectively.

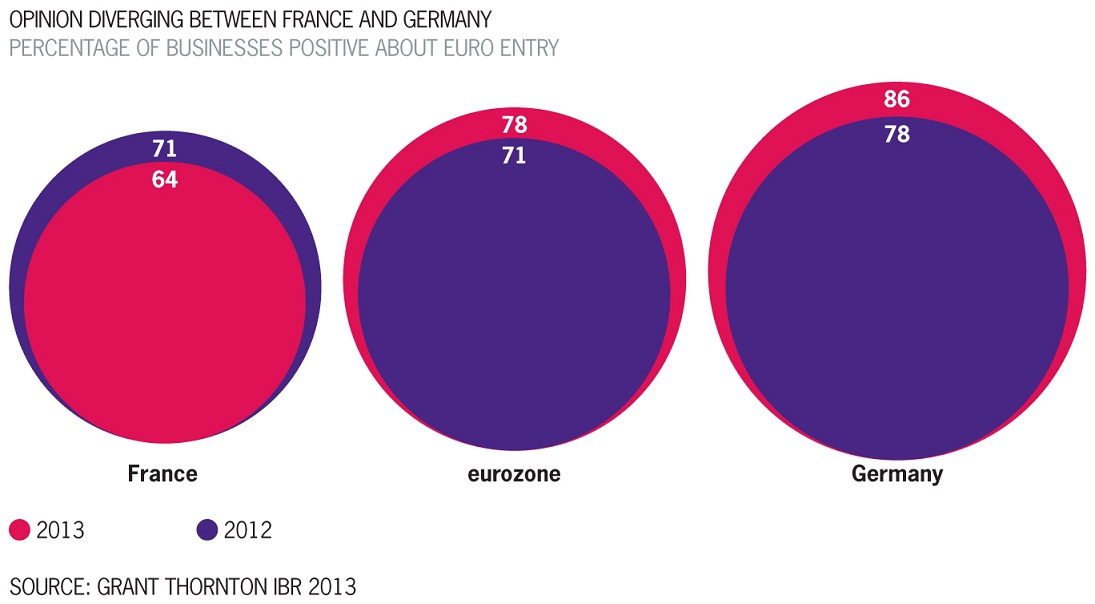

The research also asked businesses how they viewed their country’s membership in the euro thus far. 85% in Germany view membership as positive, up from 79% last year. By contrast, the proportion in France describing their membership as positive fell from 71% to just 64% - the joint lowest level in the eurozone. Moreover, one in five French business leaders (20%) describe joining the euro as negative – the highest proportion in the eurozone and well above the German result (7%).

Paul Raleigh, Global leader of growth at Grant Thornton, commented: “France and Germany have historically been at the forefront of European integration efforts, from the creation of the single market to the introduction of the single currency. Unfortunately, on the eve of the declaration that ultimately led to the creation of the European Union, we’re seeing opinion in the eurozone’s two biggest economies diverge.

"The concern for businesses is around clarity of vision. The region has been through perhaps its most challenging spell since the EU was created and the Italian elections and the bailout of Cyprus tell us the crisis is far from over. Strong, united leadership is needed to end the ongoing uncertainty and encourage business leaders to make the investments that will lead to jobs and growth."

With Germany on course to post a budget surplus in 2013 and France set to miss its 3% deficit target, business leaders in the two economies have understandably different views on debt mutualisation. Just 32% of businesses in Germany would support the introduction of so-called eurobonds, approximately half the proportion in France (60%).

Paul Raleigh added: “The question around eurobonds acts as a proxy for the confidence of business leaders in the ability of their economy to service debt. The overall public debt levels of the two economies are not too dissimilar but the German business community is clearly more confident than the French business community.”

Businesses outside the eurozone are even less supportive of further European integration, heightening fears of a 'two-speed Europe'. Just 14% of other EU businesses support further political integration, and 32% economic integration – falling to 6% and 20% in the UK. A further 29% from these economies do not want to see any further integration, compared with 9% in the eurozone. Meanwhile, the appeal of the EU is fading to business leaders outside the union: 51% believe further integration would be an advantage, down from 62% 12 months previously.

For further information please contact:

Tom Yazdi/Keith Brookbank

Linstock Communications

T +44 207 089 2080

Notes to editors

The Grant Thornton International Business Report (IBR) provides insight into the views and expectations of more than 12,500 businesses per year across 44 economies. This unique survey draws upon 21 years of trend data for most European participants and 10 years for many non-European economies. For more information, please visit: www.internationalbusinessreport.com

Data collection

Data collection is managed by Experian. Questionnaires are translated into local languages with each participating country having the option to ask a small number of country specific questions in addition to the core questionnaire. Fieldwork is undertaken on a quarterly basis. The research is carried out primarily by telephone.

Sample

IBR is a survey of both listed and privately held businesses. The data for this release are drawn from interviews with 3,100 chief executive officers, managing directors, chairmen or other senior executives from all industry sectors conducted between November 2012 and February 2013. A full list of participating economies (and total interviews) is shown below:

- eurozone (1,250): Belgium, Estonia, Finland, France, Germany, Greece, Ireland, Italy, the Netherlands, Spain

- Other EU (1,150): Denmark, Latvia, Lithuania Poland, Sweden, United Kingdom

- Non-EU (700): Armenia, Georgia, Norway, Russia, Switzerland, Turkey

Director of Public Relations and External Affairs

T +1 312 602 8955